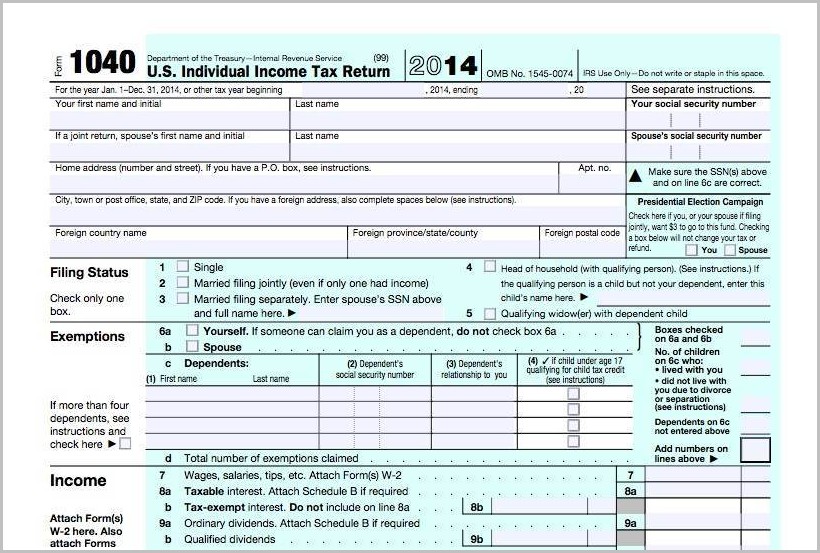

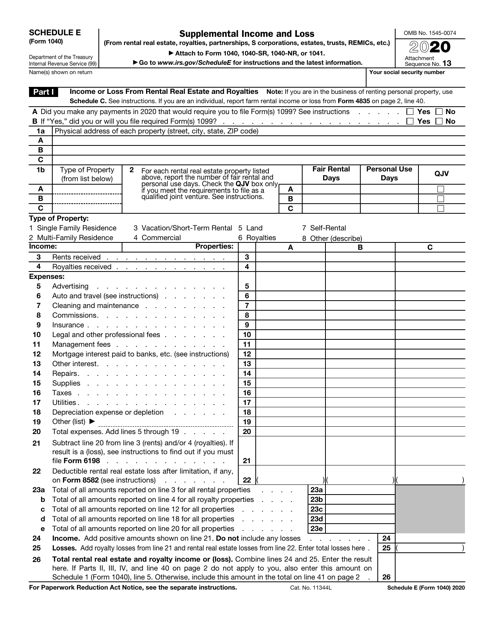

Fix Paperback and Hardcover Formatting Issues. Paperback and Hardcover Manuscript Templates. Format Front Matter, Body Matter, and Back Matter. How EU Prices Affect List Price Requirements. EIN for Corporations and Non-Individual Entities If you sold more than one personal item at a loss or received more than one Form 1099-K for personal items you sold at a loss, and you entered the total amount of sale proceeds on line 8z, you should also enter the total amount of sale proceeds on line 24z. On line 24z you would enter $700 and in the entry space next to line 24z you would write “Form 1099-K Personal Item Sold at a Loss -$700.” See the instructions for line 8z. For example, you bought a couch for $1,000 and sold it through a third-party vendor for $700, which was reported on your Form 1099-K. In the entry space next to line 24z write “Form 1099-K Personal Item Sold at a Loss” and also enter the amount of the sale proceeds. If you sold a personal item at a loss and you did not report the loss on Form 8949, enter the amount of the sale proceeds from Form 1099-K on line 24z that you reported on line 8z. On page 94, the text for Line 24z, under Form 1099-K loss reporting has been revised to read:.

If you sold more than one personal item at a loss or received more than one Form 1099-K for personal items you sold at a loss, in the entry space next to line 8z write “Form(s) 1099-K Personal Items Sold at a Loss” and enter the total amount of the sale proceeds on line 8z. In the entry space next to line 8z you would write “Form 1099-K Personal Item Sold at a Loss - $700.” See the instructions for line 24z. In the entry space next to line 8z write “Form 1099-K Personal Item Sold at a Loss” and also enter the amount of the sale proceeds. If you report the loss on line 8z, enter the amount of the sale proceeds from Form 1099-K on line 8z. If you sold a personal item at a loss, either report the loss on Form 8949 or report it on line 8z.

On page 87, the text for Line 8z, under Form 1099-K loss reportinghas been revised to read:. If, in 2022, you disposed of any digital asset, which you held as a capital asset, through a sale, trade, exchange, payment, gift, or other transfer, check “Yes” and use (a) Form 8949 to calculate your capital gain or loss and report that gain or loss on Schedule D (Form 1040) or (b) Form 709 in the case of gifts. On page 15, the text under How To Report Digital Asset Transactionshas been revised to read:. If you downloaded or printed the 2022 Instructions for Form 1040 (and 1040-SR) prior to January 20, 2023, please be advised that the instructions for reporting digital asset transactions and the instructions for Form 1099-K loss reporting have been revised.

On page 87, the text for Line 8z, under Form 1099-K loss reportinghas been revised to read:. If, in 2022, you disposed of any digital asset, which you held as a capital asset, through a sale, trade, exchange, payment, gift, or other transfer, check “Yes” and use (a) Form 8949 to calculate your capital gain or loss and report that gain or loss on Schedule D (Form 1040) or (b) Form 709 in the case of gifts. On page 15, the text under How To Report Digital Asset Transactionshas been revised to read:. If you downloaded or printed the 2022 Instructions for Form 1040 (and 1040-SR) prior to January 20, 2023, please be advised that the instructions for reporting digital asset transactions and the instructions for Form 1099-K loss reporting have been revised.

0 kommentar(er)

0 kommentar(er)